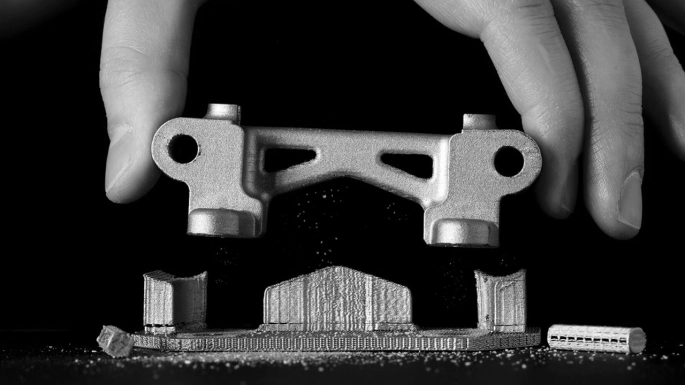

The move to conquer the 3D metal printing space is a shrewd one for Desktop Metal.

Tag: Manufacturing

Investing in a few key startups alone won’t save struggling American cities

Beyond Boston Earlier this week, it was announced that Steve Case, AOL founder and chairman and CEO of Revolution LLC, would be bringing JD Vance into Revolution in a special role. Vance, a principal at Mithril Capital Management, is best known as the author of Hillbilly Elegy, a highly-regarded account of life growing up in … Continue reading Investing in a few key startups alone won’t save struggling American cities